The Office of Policy and Management asked Bruce Hyde, the director of the Land Use Academy and UCONN Center for Land Use Education, to study Tax Incremental Financing's use for Transit-Oriented Development in Connecticut in 2013. The keynote speaker revealed his conclusion at the TOD Knowledge Sharing Forum in Hartford in January of 2014. He concluded that that the use of TIF for TOD was not feasible in Connecticut. Now just a year later as the pace of Connecticut's TOD agenda slows, we are witnessing a whirlwind of proponents advocating for facilitating the expansion of it's use.

But it is of no surprise that the advocates of this plan wish to move forward at all costs. Many testified in favor of loosening controls of this financing tool that has brought municipalities from favorable financial statuses to bankruptcy across the country.

SB 677 was drafted specifically to help fund TOD projects. From the bill's text:

But it is of no surprise that the advocates of this plan wish to move forward at all costs. Many testified in favor of loosening controls of this financing tool that has brought municipalities from favorable financial statuses to bankruptcy across the country.

SB 677 was drafted specifically to help fund TOD projects. From the bill's text:

" "District master plan" means a statement of means and objectives prepared by the municipality relating to a tax increment district designed to provide new employment opportunities, retain existing employment, provide housing opportunities, improve or broaden the tax base or construct or improve the physical facilities and structures through the development of industrial, commercial, residential, retail and mixed use, transit-oriented development, downtown development or any combination thereof, as described in section 4 of this act.(4) "Downtown" means a central business district or other commercial neighborhood area of a community that serves as a center of socioeconomic interaction in the community, characterized by a cohesive core of commercial and mixed-use buildings, often interspersed with civic, religious and residential buildings and public spaces, that are typically arranged along a main street and intersecting side streets and served by public infrastructure.(5) "Financial plan" means a statement of the project costs and sources of revenue required to accomplish the district master plan."(14) "Transit facility" means a place providing access to transit services, including, but not limited to, bus stops, bus stations, interchanges on a highway used by one or more transit providers, ferry landings, train stations, shuttle terminals and bus rapid transit stops.(15) "Transit-oriented development" means the development of residential, commercial and employment centers within one-half mile or walking distance of a transit facility, including rail and bus rapid transit and services that meet transit supportive standards for land uses, built environment densities and walkable environments, in order to facilitate and encourage the use of those services. Transit-oriented development includes, but is not limited to, transit vehicles such as buses, ferries, vans, rail conveyances and related equipment; bus shelters and other transit-related structures; benches, signs and other transit-related infrastructure; bicycle lane construction and other bicycle-related improvements; pedestrian improvements such as crosswalks, crosswalk signals and warning systems and crosswalk curb treatments and the industrial, commercial, residential, retail and mixed-use portions of transit-oriented development projects.

Sec. 4. (NEW) (Effective October 1, 2015) (a) In connection with the establishment of a tax increment district, the legislative body of a municipality shall adopt a district master plan for each tax increment district and a statement of the percentage or stated sum of increased assessed value to be designated as captured assessed value in accordance with such plan.

As one can see in Sec. 4 of the legislation, the TIF model is based upon land value capture models used to procure investment in infrastructure. In the State of Connecticut there are various layers of tax revenues that are supposed to be used to fund such infrastructure projects, but those funds have been diverted as budget shortfalls and transportation fund raiding continues. In this regard, the State of Connecticut legislature has defaulted on their duties to state taxpayers and is now pushing their most basic responsibility onto municipalities whom will soon pass the burden onto local taxpayers. Each Connecticut citizen's personal share of the combined federal and state is already more than $68,400.

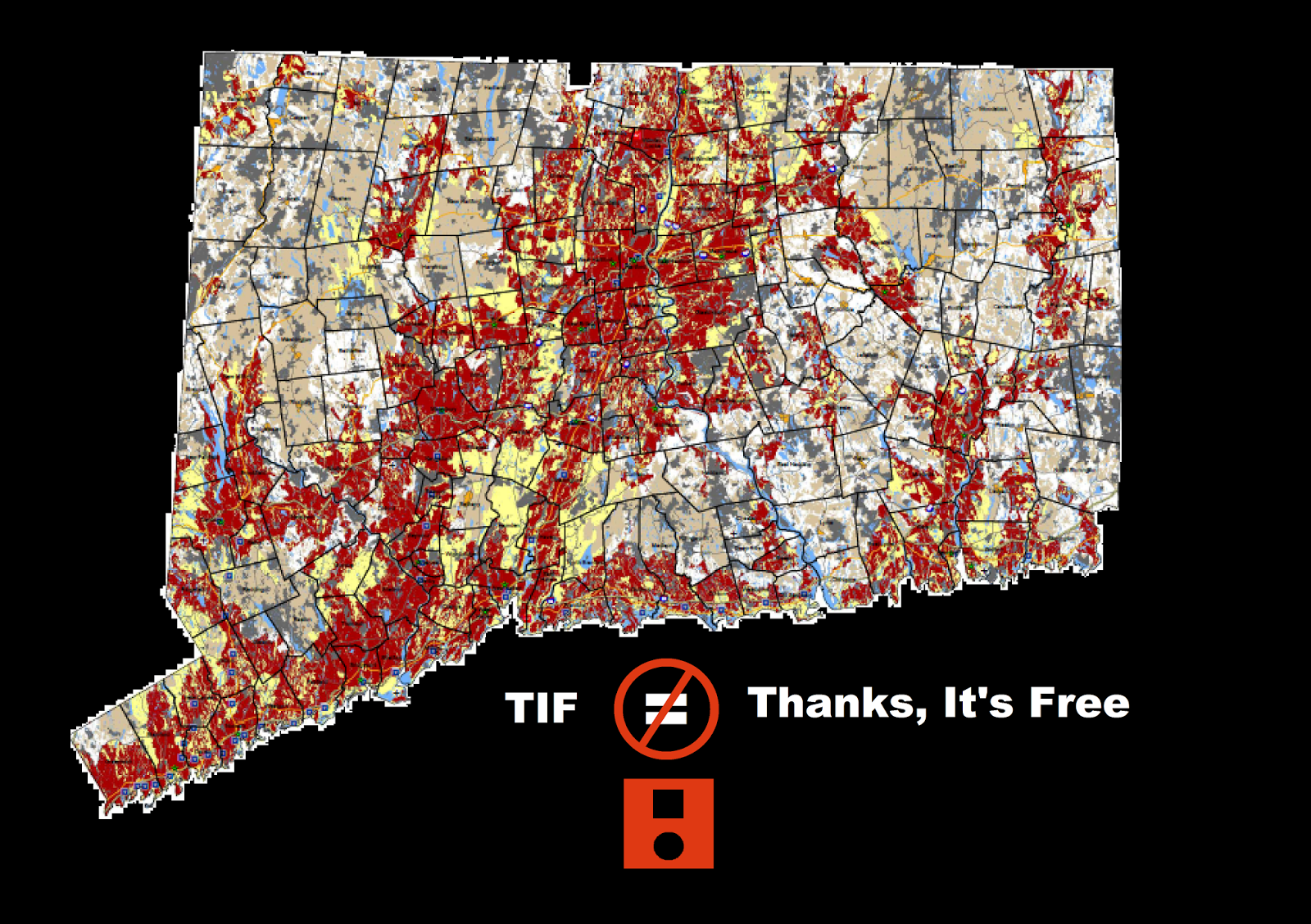

As one can see in Sec. 4 of the legislation, the TIF model is based upon land value capture models used to procure investment in infrastructure. In the State of Connecticut there are various layers of tax revenues that are supposed to be used to fund such infrastructure projects, but those funds have been diverted as budget shortfalls and transportation fund raiding continues. In this regard, the State of Connecticut legislature has defaulted on their duties to state taxpayers and is now pushing their most basic responsibility onto municipalities whom will soon pass the burden onto local taxpayers. Each Connecticut citizen's personal share of the combined federal and state is already more than $68,400. Increased tax revenues due to increased land value incurred from the investment of transit and accompanying presumed economic growth is now a selling point for the state legislature to convince municipalities to pick up their delinquient tab. Yet even on a large scale, the theory of such returns from such progressive keynesian infrastructure investments has been disputed and debunked with considerable evidence. This leaves many considerations to be addressed by the electors of communities. As Land Value Taxation affects specific property owners differently as surrounding property uses change, so does the increase in taxation adversely affect those who do not wish to develop their property in a manner consistent with surrounding high-density developments in new urbanism projects. Graft will determine the winners and the losers quickly in communities eager to follow the revenue stream.

TIF is the lifeline and the gravy train for Master Developers as their risk is largely removed and placed upon the often unwilling hosts of future generations. The funding avenue leads to guaranteed increases in municipal taxes should the project become insolvent. This bill may expand options for municipalities to work independently from the state legislature using TIF to build sustainable development projects, but it is of not much consequence who is building high-density housing in a community's downtown but rather whether or not the community's electors support such action. One can easily find that municipal control of these sustainable development does not constitute the will of the people in more than a few communities in Connecticut.

The bill's language and testimony illustrates the goals of those looking to build their utopian, new urbanism projects and the various extremes the state's legislature will go to make that vision into a reality. It leads one to question whether demand for such projects exists since private investment has not brought the planners' vision to a reality. One of the greatest examples of those limits is hb6851. The use of Tax Incremental Financing for large-scale new urbanism projects has brought many municipalities from good financial standing into bankruptcy since the recession began. It would appear that the sate's declining financial standing makes them more willing to put that risk onto out towns and cities.

CRCOG of course testified in favor of the bill. From their testimony:

"CRCOG supports Senate Bill 677, “An Act Establishing Tax Increment Financing Districts” to provide our member towns more tools to deal with development and redevelopment and to address the opportunities of 17 rapid transit and rail stations in the region.

This bill would allow municipalities to invest in greater development and redevelopment of key infrastructure to support the state’s and Planning and Development Committee’s goals of concentrating growth along transportation corridors, increasing housing choices detailed in the State Plan of Conservation and Development. ...

...As proposed expanded Tax Increment Financing proposed by Senate Bill 677 offers towns and cities the opportunities of new, non-state resources for the development and redevelopment including transit oriented development at rapid transit and rail stations"

The American Planning Association has been a proponent of the social and environmental justice aspects of Transit-Oriented Development for many years. The Chair of the Connecticut Chapter of the APA testified in favor of both SB 677 and HB 6851 on the March 3rd Planning and Development public hearing for the bills, She explains in her testimony that the future tax revenues for the development would roll back into a fund for future development instead of paying down the debt. Notably, she proclaims that the Tax Incremental Financing would be used for "blighted areas, downtown areas and potentially transit-oriented development." It is apparent from the bill's language that TOD is exactly what it is designed to fund. In the case of SB677, TOD stands for Transit-Oriented Debt. For many planners and stakeholders of this agenda, increasing public debt and taxation is not a risk to weigh, but a means to an end.

No comments:

Post a Comment